Irvine’s housing market is as dynamic as a wave in the Pacific, ever-changing and influenced by multiple factors. The real estate scene here reflects that of Orange County at large but carries its own unique traits.

Analyzing Current Market Trends

One key factor to note is the current seller’s market environment we’re experiencing. Sellers are finding themselves with more bargaining power due to limited supply and high demand for homes in popular neighborhoods like Irvine Pacific.

This situation has led to an interesting paradox – despite home prices dropping slightly (1.7% compared to last year), mortgage payments have increased because interest rates are on the rise according to National Association of Realtors. It’s akin to getting a discount on your favorite pair of shoes, only for sales tax to be higher than usual.

In this context, it might seem like riding against a tidal wave when venturing into such unpredictable waters. But remember, every challenge brings opportunity if you understand how these forces work together – just like learning how surfers ride those big waves off Huntington Beach.

Note: No matter where you decide to plant your roots within Orange County or specifically in Irvine Pacific areas; understanding current trends can help navigate this exciting journey effectively.

Remember that even though buying property may feel daunting right now, homeownership still remains one of the most reliable ways towards wealth creation over time.

Preparing for Your Home Purchase

The path to homeownership starts long before you tour your first property. It begins with improving credit scores and saving for a down payment, both of which can be challenging but rewarding tasks.

Financial Planning for Homeownership

A home purchase is more than just the price tag on the house; it includes various other costs such as closing fees, homeowner’s insurance, and potential repair expenses. That’s why budgeting effectively becomes critical in this journey.

If you’ve been asking yourself “How can I improve my credit score? Many others find themselves in the same predicament, wondering how to improve their credit score. You’re not alone. Simple steps like paying bills on time or reducing debt levels will help increase your rating over time.

When it comes to savings, remember this statistic: typical monthly mortgage payments are 35% higher than a year ago due to increasing interest rates. So if you want a head start in securing your dream home without breaking bank accounts – save money.

- Saving requires discipline and patience but think about how great it’ll feel when that key turns into YOUR front door lock.

- Your efforts today towards boosting credit scores or stashing away cash will significantly improve future financial stability while owning a home.

- To put things into perspective – having enough funds saved up could mean less reliance on loans (and hence lesser debts) making homeownership even more enjoyable experience.

Note: While preparing financially may seem daunting initially, following structured advice from experts like those at Bankrate can simplify the process. Remember, every little step you take now brings you closer to your new home in Irvine.

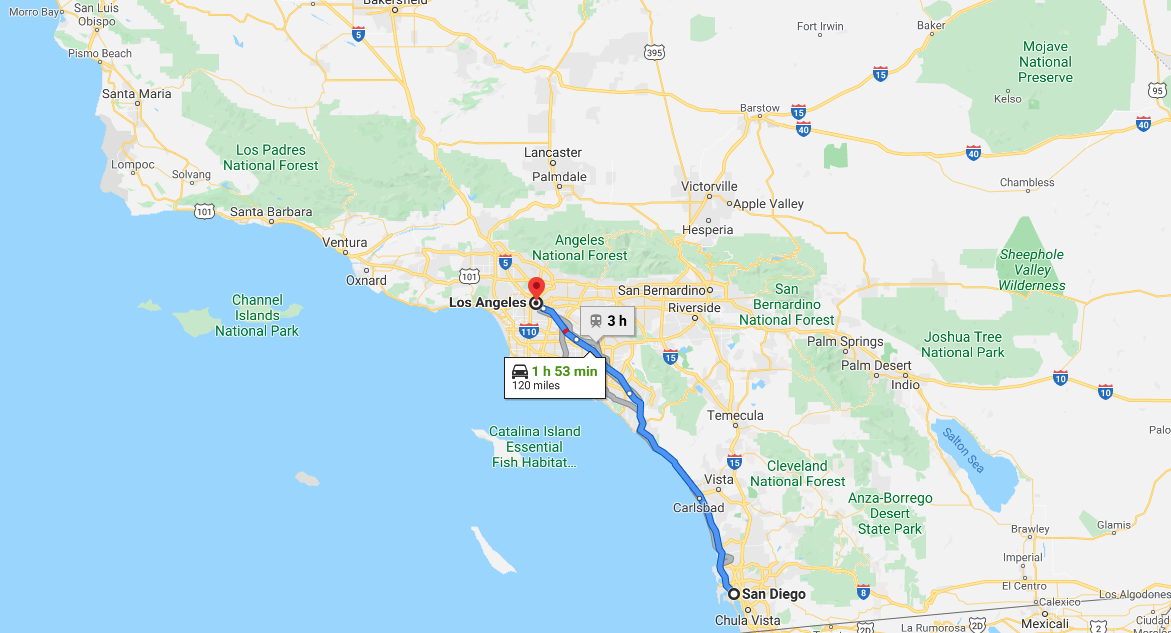

Navigating the Homebuying Process in Irvine

So, you’re ready to plunge into Irvine’s real estate market? Great. The first step is getting pre-approved for a home loan. It’s like having an all-access pass at a concert – it lets sellers know you mean business.

Bankrate can help guide you through securing your pre-approval. This step is crucial because it sets boundaries on what homes are within reach and also shows sellers that you’re serious about buying.

Securing Pre-Approvals

No one desires to be enamored with a residence they can’t manage. That’s why pre-approvals are so important; they provide clarity on what price range to consider while shopping around.

Besides, who wouldn’t want to get ahead of the competition in this bustling seller’s market?

Understanding the Closing Process

You’ve found ‘The One,’ and now it’s time to seal the deal – literally. The closing process might seem complicated but fear not; we’ve got some pointers.

Closing involves finalizing mortgage details, conducting title searches, and signing stacks of paperwork (be prepared.). Remember those pesky unexpected repairs that tend sneak up? They could appear during inspections done at this stage too.

- To avoid nasty surprises later on, save money beyond just your down payment,

- This additional cash will serve as your safety net when such unplanned costs crop up after moving in.

Choosing the Right Real Estate Agent in Irvine

Finding an experienced real estate agent is like discovering a hidden treasure map. They guide you through twists and turns, help avoid pitfalls, and lead you straight to your dream home.

But where do you find these rock-star agents? One of our favorite places to start looking is Redfin’s agent search. It gives you access to top-notch experts right at your fingertips.

An expert agent doesn’t just show properties; they make sure every step of the journey aligns with your needs. The key stats say it all: working with an experienced real estate agent can speed up the home search by leaps and bounds while also giving you a leg-up during negotiations.

The Importance of Experience

You wouldn’t let someone who’s never cooked before prepare Thanksgiving dinner, would you? Similarly, trusting inexperienced agents could result in half-baked results. With seasoned pros, however, expect gourmet-level outcomes. Experienced real estate agents have seen it all – bidding wars gone wild or buyers backing out last minute – so they know how to handle tricky situations that may arise.

Tips for Finding Your Rock-Star Agent

A great tip when seeking expert guidance is not rushing into commitments. Take time to interview several potential candidates before making any decisions. And remember – chemistry matters. You want someone who understands what makes YOU tick as well as ticking off their own professional checkboxes.

Pitfalls To Avoid When Choosing An Agent

Making snap decisions based on online reviews alone isn’t always reliable because everyone’s experience varies greatly from one another’s personal perspective. Therefore, be wary of those glowing reviews and instead rely on your own intuition when you meet with someone in person.

Making a Competitive Offer

So, you’ve found your dream home in Irvine. But how do you ensure that your offer stands out among others? The key lies in understanding the seller’s motivation and making an all-cash deal.

The competitive real estate market of Irvine can be challenging to navigate. Customize your offer to fit the seller’s requirements; this may help ensure that it is accepted. Maybe they need more time before moving or perhaps a quick close; tailor your proposal accordingly. This approach aligns with their motivations and significantly increases acceptance chances.

All-cash deals are another effective strategy, particularly in hot markets like ours where multiple offers on properties are common occurrences. Sellers often favor these transactions because they eliminate financing contingencies and streamline closing procedures – this makes them highly appealing even if they aren’t the highest bid.

A cash offer, though not feasible for everyone, sends a powerful message about your buying power and seriousness about securing the property.

Tips for Making Your Offer Stand Out:

- Show Proof of Funds: If you’re planning an all-cash purchase, providing proof demonstrates credibility which might give you an edge over other buyers who haven’t done so yet.

- Determine Seller’s Motivation: Sellers may have unique requirements beyond price – understand what those might be and customize accordingly.

- Limited Contingencies: Cutting down on contingencies such as inspection periods or financial conditions could make it easier for sellers to say yes.

Remember. While offering cash has its advantages, it’s crucial not to stretch yourself thin financially just because we’re in a competitive market.

Every situation is unique, so make sure you’re making the best decision for your circumstances.

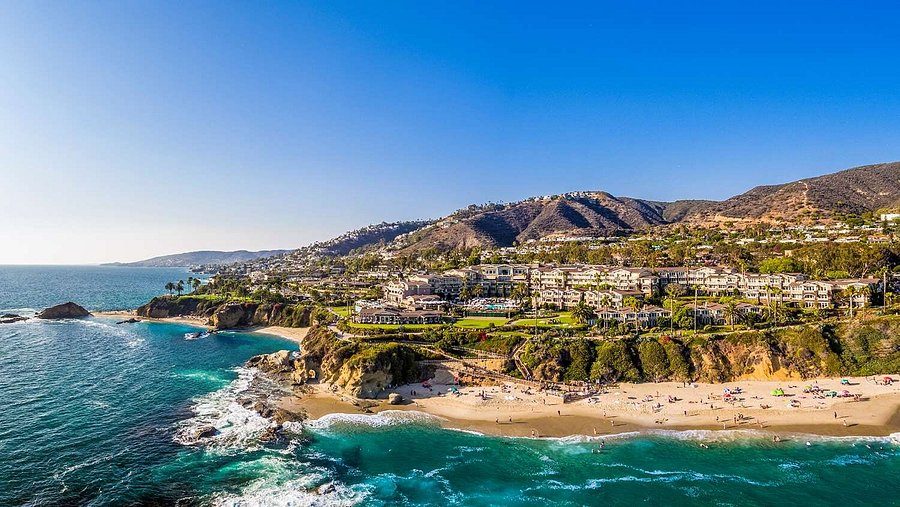

Exploring Irvine Neighborhoods for Your New Home

Moving to a new city like Irvine can feel daunting, but finding the right neighborhood can make it more manageable. If you’re looking at Orange County living, here are some of Irvine’s popular neighborhoods that could be your next home.

Woodbridge: Family-Friendly Living

A gem among Irvine neighborhoods, Woodbridge is known for its top-rated schools and family-friendly amenities. It boasts two lakes with beach clubs, numerous parks and swimming pools – an ideal place if you have kids or just love outdoor activities.

Turtle Rock: Close to Nature

If being close to nature is important to you, consider Turtle Rock. Surrounded by open space preserves and trails while still being conveniently located near shopping centers makes this spot perfect for those seeking balance in their lifestyle.

Quail Hill: Luxurious Suburban Life

In contrast, Quail Hill offers luxurious suburban life. This neighborhood features upscale homes surrounded by greenery yet has easy access to freeways – truly offering the best of both worlds.

Finding affordable homes might mean expanding your search beyond these desired neighborhoods though. Renting first before committing to buying a property in these areas may also help determine if they are indeed the right fit for you.

Note: The median house price across all these areas dropped 1.7% compared last year; making now potentially a good time buy. So start exploring.